This article needs additional citations for verification. (January 2020) |

| |

| |

| Type | International financial institution |

|---|---|

| Location | |

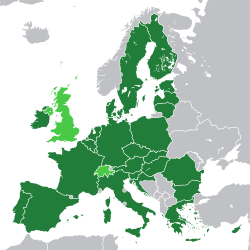

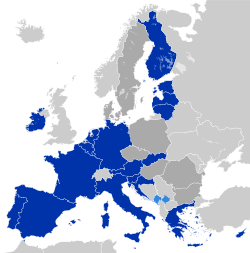

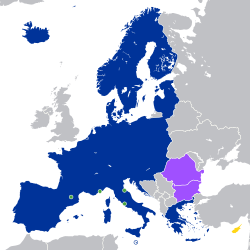

| Owner | EU member states |

| Website | www |

| This article is part of a series on |

|

|---|

|

|

The European Investment Fund (EIF), established in 1994, is a financial institution for the provision of finance to SMEs (small and medium-sized enterprises), headquartered in Luxembourg. It is part of the European Investment Bank Group.

It does not lend money to SMEs directly; rather it provides finance through private banks and funds. Its main operations are in the areas of venture capital and guaranteeing loans. Its shareholders are: the European Investment Bank (62%); the European Union, represented by the European Commission (29%); and 30 financial institutions (9%).[1]

The European Investment Bank Group is able to assist the development of a broader creative, green ecosystem through the European Investment Fund: venture capital funds, technical transfer, business perspectives, and private-sector equity (infrastructure funds) in general.[2][3]

Since 2015, the EaSI Guarantee Instrument (EU Programme for Employment and Social Innovation), managed by the European Investment Fund, has provided over €280 million in guarantees across Europe and is expected to provide over €3 billion in financing to micro-enterprises and social enterprises. In the coming years, the EIF intends to continue providing assistance to these types of final beneficiaries in areas heavily impacted by the transition to a low-carbon economy.[4]

The EIF is managed by a Chief Executive who acts independently in the EIF's best interests. As of January 1, 2023, the Chief Executive is Marjut Falkstedt.[5]

See also

[edit]Sources

[edit]- ^ "EIF – Shareholders".

- ^ Bank, European Investment (14 December 2020). The EIB Group Climate Bank Roadmap 2021-2025. European Investment Bank. ISBN 978-92-861-4908-5.

- ^ "OTB Ventures launches new $60m fund to back European businesses at the next stage of growth". eif.org. Retrieved 12 October 2021.

- ^ "EaSI Guarantee Instrument". eif.org. Retrieved 18 October 2021.

- ^ "Senior Management". www.eif.org. Retrieved 5 February 2024.